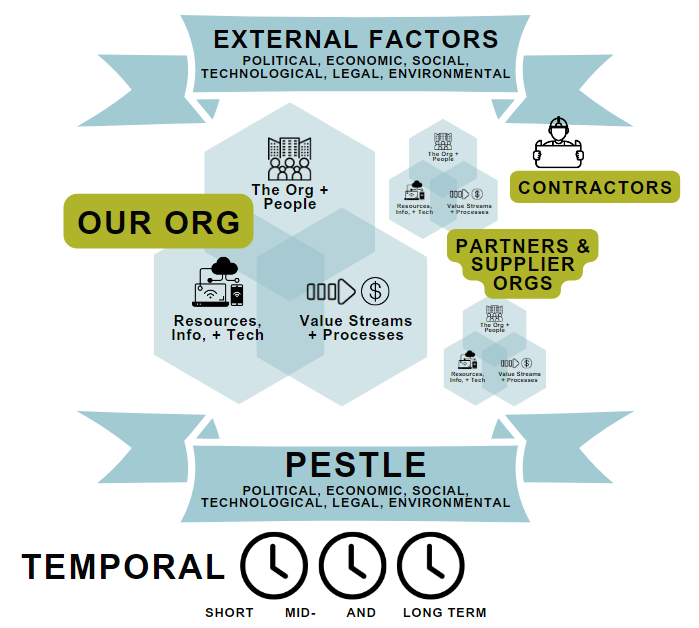

ITIL 4 defines a practice a practice is a A set of organizational resources designed for performing work or accomplishing an objective. These resources come from any or all of the dimensions shown in the center of the image below:

The purpose of the portfolio management practice is to ensure that the organization has the right mix of programs, projects, products, and services to execute the organization’s strategy within its funding and resource constraints.

If you are starting your portfolio management practice, understand not only the dimensions shown above, but zoom out to understand the wider context: the PESTLE factors… the temporal factors. Understand the context (zoom in and out to fully have a holistic view), engage with your stakeholders, and get your hands on key business documents that will help set the stage for success. These documents provide the context, direction, and governance needed to align the portfolio with the organization’s broader goals.

Since a lot of new portfolio managers ask “What documents do I need to make?” let’s walk through the key documents and how they play into portfolio management.

Before you make any docs (as eager as you are to) make sure you go LOOK AT THE BUSINESS DOCS and that you understand your orgs vison, mission, and values. Specifically, get your hands on these biz docs:

1. Vision and Mission Statements

At the heart of any organization are its vision and mission statements. These documents articulate the long-term goals (vision) and the organization’s purpose (mission). They provide a high-level guide for what the portfolio should aim to achieve. Every project and program within the portfolio should align with these overarching statements to ensure that the organization is moving in the right direction.

- Vision Statement: Where the organization aspires to be in the future.

- Mission Statement: An in-the now statement of purpose.

2. Organizational Strategy and Objectives

The vision is so far off and big…. how do we make it real? The organizational strategy and strategic objectives further refine the direction set by the vision and mission. These documents break down the vision into goals (typically qualitative and broad), chunking those goals down into objectives (clear and measurable), and creating a roadmap for what the organization wants to achieve in the short, medium, and long term.

- Strategic Plan: Outlines the long-term goals and strategies the organization will pursue. The strategy is the broad approach taken (in this case the broad approach the org takes) to achieve its objectives.

- Strategic Objectives: Specific, measurable goals that align with the strategic plan.

These objectives feed directly into portfolio management by guiding which projects and programs are prioritized and how resources are allocated. E.g. Strategy docs are passed to the portfolio management practice and business docs are created for potential aligned projects, programs, etc.

One you get your hands on your org’s strategy docs and objectives, PMI.org recommends also getting your hands on the inventory of work (what’s inflight, what’s brewing), org process assets (OPAs) and portfolio process assets (if you have them), and that you fully understand your relevant enterprise environment factors (EEFs) as well.

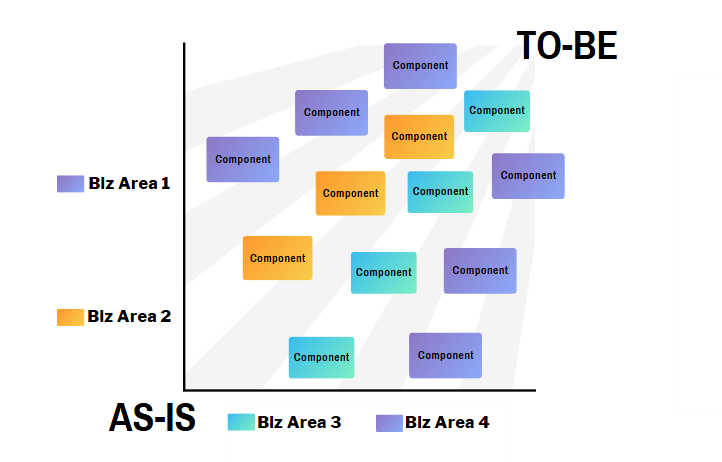

You can create an integrated view of strategic alignment (like really — you can make it). It would show how the components of your portfolio align with the strategy. Here is an example:

Understand Your Organizational Governance Structure

A governance model provides the rules of the road, the guardrails, the toll gates… It outlines the roles and responsibilities for decision-making within the organization. It ensures that there is a structured approach to how decisions are made and who makes them.

Governance is the means by which [something] is directed and controlled. Organizational governance is the means by which your org is directed and controlled.

Portfolio governance is the means by which your portfolio is directed and controlled.

It’s great to have rules of the road, etc., but we also need to see a governing body — actual people. Thus we see:

- Org level – governing body is typically the Board of Directors + Audit Committee + shareholders. The governing body is accountable at the highest level for the performance and compliance of the organization.

- Portfolio Level – governing body can take on many forms, but again, it is a group of people, e.g. a Portfolio Governance Board.

- Program Level – Program Governance Board

- Project Level – Project Governance Board and/or Project Steering Committee

The Documents You Create to Kickstart Portfolio Management

Once you’ve had some awesome convos with the key players and you have gathered and reviewed the foundational business documents, understand your context, etc., the next step is to create the key documents that will guide the portfolio management process. These documents help establish the scope, direction, and governance of the portfolio.

1. Portfolio Strategic Plan

1. Portfolio vision and objectives

2. Allocation of funds and resources for different types of initiatives (e.g., portfolio, sub-portfolio, other work), showing how these contribute to organizational strategy and objectives

3. Portfolio benefits, expected results, and value

4. Measurable goals and guidance

5. Resource information (type and quantity required)

6. Organizational structure and areas involved

7. Portfolio organizational structure

8. Portfolio structure

9. Prioritization model for initiatives to be appraised and prioritized

10. Organizational risk tolerance

11. Stakeholder expectations

12. Communication needed for successful change implementation

13. Key assumptions, constraints, dependencies, and risks

2. Portfolio Charter

The portfolio charter formally authorizes the portfolio and provides a high-level description of the portfolio’s purpose, objectives, scope, timeline, etc. It’s the document that gives the portfolio manager the authority to execute the portfolio management processes and allocate resources to portfolio components.

1. Portfolio vision

2. Portfolio objectives

3. High-level scope

4. Benefits

5. Justification and alignment

6. Success criteria

7. Resources

8. High-level timeline

9. Forecast of when and how the portfolio will deliver value to the organization

10. Portfolio structure

11. Stakeholders, their expectations, and communication requirements

12. Organizational areas in scope, hierarchies, and portfolio goals

13. Performance expectations

14. Key risks

15. Assumptions, dependencies, and constraints

3. Portfolio Roadmap

The portfolio roadmap provides a high-level visual overview and timelines of the portfolio components.

4. Portfolio Management Plan

The portfolio management plan is the comprehensive document that outlines how the portfolio will be managed, monitored, optimized, and controlled.

1. Governance model

2. Portfolio oversight

3. Managing strategic change

4. Change control and management

5. Balancing portfolio and managing dependencies

6. Measuring and monitoring performance and value

7. Portfolio performance reporting and review

8. Communication model as part of the communication management plan

9. Portfolio risk management planning

10. Procurement procedures

11. Managing compliance

12. Portfolio prioritization model

13. Different methodologies or approaches for different classes and types of components

14. Categories for portfolio components

Starting a portfolio management initiative requires a blend of existing organizational documents and newly created portfolio-specific documents. By leveraging foundational elements like the vision, mission, and strategic objectives, and then building on them with documents like the portfolio charter, roadmap, and management plan, you set the stage for a well-aligned and effectively managed portfolio. Each document plays a vital role in ensuring that the portfolio not only aligns with organizational goals but also delivers measurable value over time.